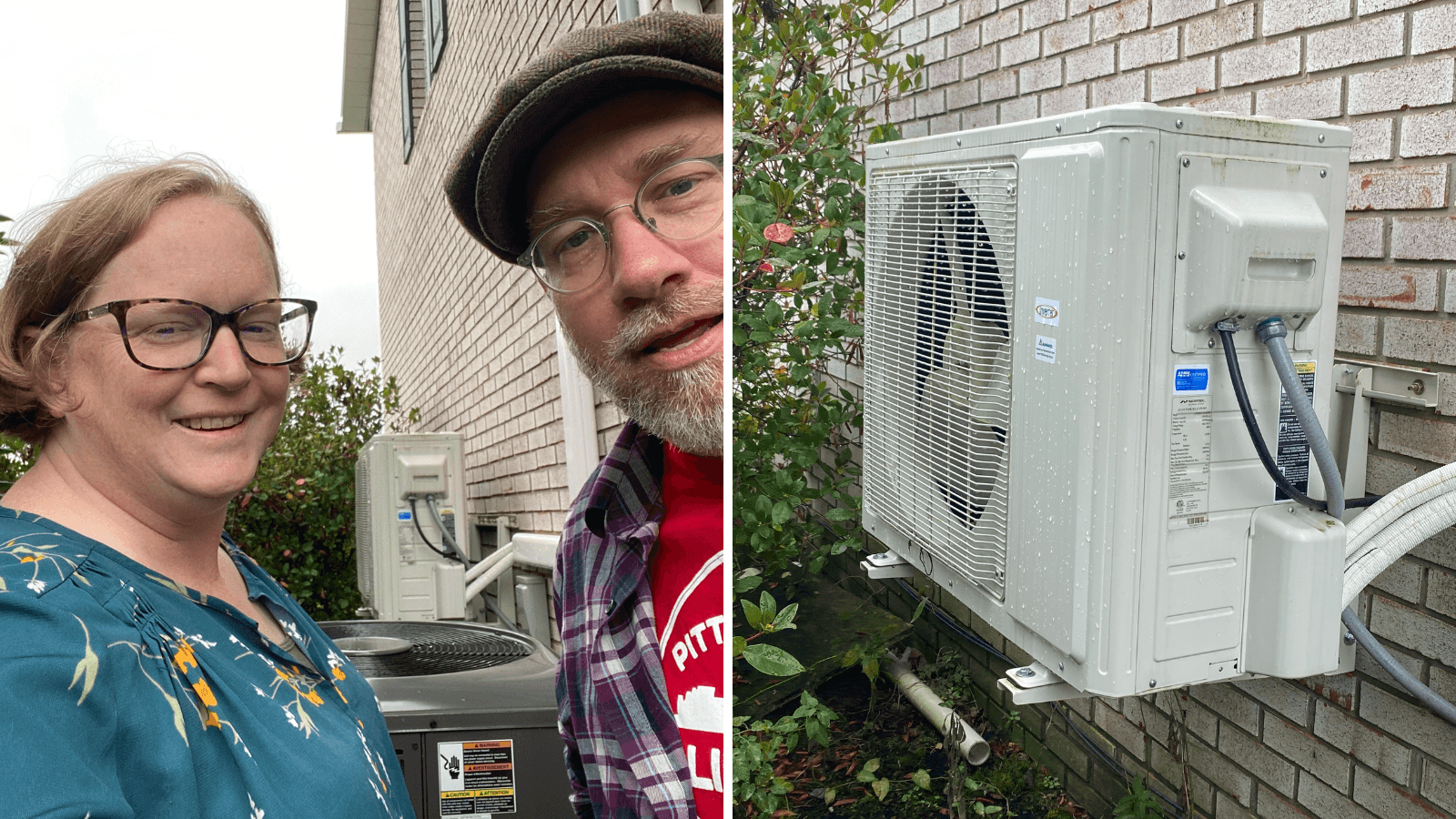

Photo: Kim and her husband, Dan, stand in front of their home's new heat pumps

I am one of the thousands of Pennsylvanians who have recently benefited from an Inflation Reduction Act (IRA) tax credit when filing my 2023 taxes.

My home was previously heated entirely by oil, and when gas prices rose significantly a couple of years ago, we saw the huge impact inefficient heating and varying gas prices could have on our family budget. Within six months, the cost of filling our tank with heating oil nearly doubled! For most Americans, my family included, a big increase like that can come as a shock and be difficult to handle.

So, when our air conditioning also needed to be replaced, we investigated our options. We received estimates for replacing the air conditioning, which would have only cooled the second story of our home. The option we went with instead were heat pumps, which provide both heating and cooling in all areas of our house except our basement. We did this for less than the cost of replacing only our air conditioner. On top of those savings, we received a tax credit to help offset the cost of the upgrade. Our home is now primarily heated and cooled through heat pumps, relying on oil heat only on extremely cold days.

We have seen several benefits to this upgrade. First, we received a tax credit that covered about 30% of the cost of the heat pump itself. We have gained huge savings in terms of heating costs, with the average sum of our energy bill decreasing significantly in the winter months. I suspect this is because our heat pumps are much more efficient than the old boiler we relied on all winter in the past. Also, when comparing our annual cost of energy and heating combined, we save an estimated $200-300 a month. This has been a welcome savings for our family!

Finally, heat pumps are the most efficient source of heat for our home, meaning that we are using less energy and sending fewer toxins into the atmosphere. As an evangelical Christian, I care deeply about the health of God’s children. And as a mother, I want to defend the wellbeing of my own children, doing everything I can to keep them safe and healthy. Having a source of heat that uses less energy is important to me because it helps keep the air we breathe and the water we drink purer and safer. This is a benefit not only for my own children, but also for those living near fossil fuel energy production.

If you’ve been considering making energy efficient upgrades and benefitting like our family has, now may be the time for you to take advantage of IRA tax credits. Rewiring America has a user-friendly tool that estimates the tax credits you might receive on various types of upgrades, including heat pumps. If you make any efficiency upgrades to your home, from your water heater to going solar, EEN would love to hear your story, too!